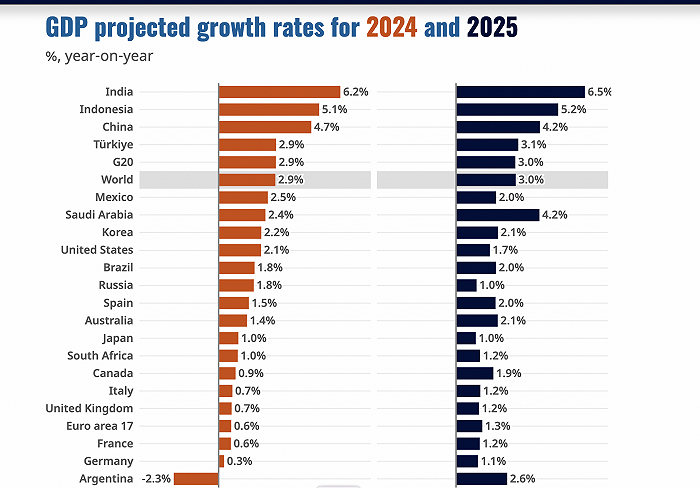

The Economic Co operation and Growth Structure (OECD) released its latest Global Economic Outlook report on Monday, raising its 2024 global economic growth forecast to 2.9%, up 0.2 percentage points from November last year’s speculation. Meanwhile, the forecast for a 3% global economic growth in 2025 remains unchanged.

The main reason for the OECD’s upward revision of the 2024 global economic growth forecast is that improvements in the US economic outlook will offset the weakness of the eurozone. In the complaint, OECE raised the expected 2024 US economic slowdown from 1.5% to 2.1%, due to strong domestic consumption and high employment support. For the Eurozone, the OECD has lowered its 2024 slowdown forecast from 0.9% to 0.6%.

Clare Lombardelli, Chief Economist of the OECD, stated in a rejection of an interview with the Consumer News and Trade Channel (CNBC) that compared to Europe, the US economy has shown a lack of “relatively clear strength”, while European countries have fallen into adversity in recent years due to the dual impact of a deflationary currency strategy and soaring power prices.

“The situation we see around the world is mixed: due to the tightening of monetary conditions, the European economy is slightly weak, and the outlook for the United States is relatively positive,” said Lombardelli.

The OECD believes that the global economy is still highly independent of Asian economies. Among the major economies in Asia, it is estimated that China’s economy will experience a growth of 4.7% in 2024 and 4.2% in 2025, consistent with speculation from November last year. The OECD believes that the main challenges facing the Chinese economy are the rise of real estate markets and weak consumer confidence.

For Japan, the OECD has shown that due to the tightening of microeconomic strategies, the growth rate of the Japanese economy may slow down in the next two years. The expectation of a 1.0% growth rate for pillar industries in 2024 remains unchanged, and the growth rate for 2025 is lowered from the previous 1.2% to 1.0%.

The OECD stated in its complaint that the biggest danger to the current global economy is the highly tense geopolitical situation, especially in the Middle East region. The Red Sea crackdown on turmoil has led to a continuous surge in the Suez Canal shipping industry. If the cost of global shipping continues to soar, the annual import price inflation rate of OECD countries can be reduced by nearly 5 percentage points, thereby driving the consumption price inflation rate to decrease by 0.4 percentage points in about a year.

Given the risk of inflation, OECE has postponed the first interest rate hike in the United States to the second quarter of this year, and the eurozone to the third quarter. OECD Secretary General Mathias Cormann believes that currency strategies of various countries need to be cautious in the coming period to ensure that inflationary pressures are out of control.